The UN estimates that spending $7 trillion each and every yr is had to get nearer to its Sustainable Building Objectives by means of 2030, and six out of the $7 trillion is reliant at the non-public sector. As two-thirds of the financing should be supplied by means of banks, their position is instrumental in attaining the Objectives.

The excellent news is that banks around the globe have now put sustainability at the leading edge in their expansion challenge. With widespread bulletins of recent weather alliances and partnerships round their ESG commitments, it’s obvious that intent and motivation are at a top. On the other hand, as rules and reporting pointers tighten and the cost of carbon sores, monetary establishments are repeatedly exploring extra intensive fashions to ship on their sustainability guarantees.

At Capgemini, via our concept management in sustainability and constant innovation, we now have recognized the next key pillars that we imagine are integral for the luck of your weather technique.

COMMITMENT

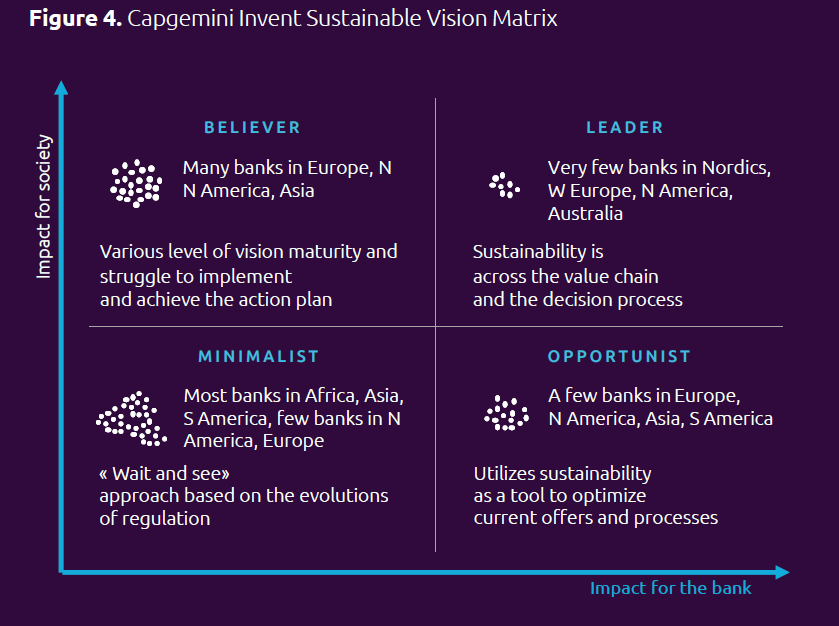

With consumers’ consideration and loyalty to ESG standards expanding, it is very important for banks to outline a practical sustainability time table and make sure it’s communicated proper. It should encapsulate obviously mentioned objectives in explicit spaces with metrics in position to reach them. With Capgemini’s Sustainable Imaginative and prescient Matrix, we will permit the overview of the financial institution’s imaginative and prescient and place them in line with their ESG ambitions.

To look how the marketplace rewards their dedication, enticing stakeholders (consumers, regulators, buyers, NGOs) is crucial to improve the transformation and create visibility within the ecosystem. Banks wish to have interaction their purchasers and companions towards a social economic system and reconsider the logo revel in. On the other hand, that is conceivable provided that their very own workers proportion the imaginative and prescient and trail ahead. This may occasionally call for a cultural shift to improve the transition, and workers will probably be responsive provided that they perceive the “why?” and the “how?” via consciousness and trainings.

ACTION

We’re seeing larger proliferation of key weather subject matters similar to web 0, decarbonization, financed emissions, and considerable investments in inexperienced financing. Banks are aggressively construction sustainability into their merchandise with inventions similar to recyclable playing cards, loyalty issues to incentivize a low-carbon way of life for retail banking, or monetary merchandise like inexperienced bonds for funding banking. Whilst experiments proceed to innovate the be offering portfolio, financing the transition and footing new inexperienced companies will proceed to take middle level. Targeted tasks, methods with centered making an investment plans, and adoption of inexperienced IT practices to propel the time table should proceed.

MEASURE

We will speak about this throughout 3 key elements.

Internalize Governance

With commitments made and movements taken, banks now desire a sturdy governance construction for weather affect that runs all through the group. Local weather menace must be established as a fundamental menace and built-in into the venture menace control framework, i.e. a fundamental menace framework coupled with a menace urge for food overview: an interaction of audit and menace tracking at the side of a transparent line of reporting and escalation mechanism. The board / best control lays down the wider theme and ESG motion plan with the stakeholders, and choice makers throughout trade spaces are made in command of the carbon affect their choices have.

Track (Metrics & Goals)

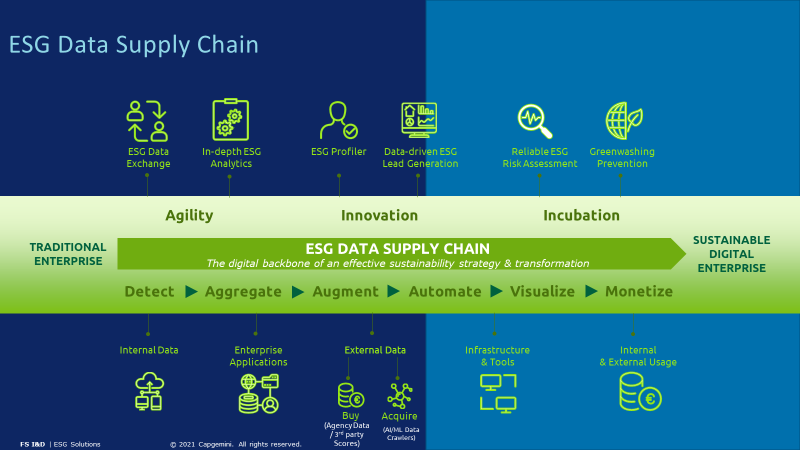

As soon as the important signs (KPIs) for weather menace tracking and control are in position, banks will then require the suitable infrastructure to reach them. Refined monitoring mechanisms similar to Capgemini’s intricate ESG information provide chain can permit a repeatable, industrialized procedure for conserving ESG information related, present, and exploitable on an ongoing foundation as an enterprise-wide asset.

To reinforce their metrics and objectives, establishments should proceed to broaden their technique, including granularity in monitoring and updating exterior consumer and business information as those grow to be to be had through the years. Increasingly benchmarks and menace scoring fashions are underneath construction and concurrently being followed – e.g. Moody’s CreditEdge style, 4 Twenty Seven’s bodily menace ratings, the CDP (Carbon Disclosure Mission), NGFS 2020, and others.

Tension Checking out

Lately, the Financial institution of England (BOE) and the Eu Central Financial institution (ECB) printed their weather rigidity assessments as a studying workout to evaluate banks’ climate-risk preparedness. Although recently restricted in scope, different banks are anticipated to apply their lead in devising their very own rigidity assessments, which can quickly be made obligatory.

To reach a forward-looking weather menace technique, banks should overview the weather affect around the quick, medium, and long-term horizon. As soon as deviations are captured, they may be able to run simulations with other variations and combos in their weather motion plan and persistently realign their efforts in the suitable path. Situation research throughout all trade actions/sectors will assist determine the underlying bodily in addition to transition menace. Moreover, it’s going to overview the possible affect on their steadiness sheets and the way productiveness enhancements will make amends for losses in positive sectors because of the larger carbon costs.

DISCLOSURES

The present ESG disclosures panorama may also be overwhelming to start with look. Particularly with greenwashing allegations, tighter scrutiny, and regulatory interventions on the upward thrust. Proper reporting on weather technique objectives and disclosures at the growth made are vital to showcasing the price created by means of banks.

Organising credibility within the ESG house will probably be completed via larger transparency at a granular stage. Demonstrating sturdy compliance to reporting requirements similar to TFCD (Process Power on Local weather-Similar Monetary Disclosure), GRI (International Reporting Projects), and SASB (Sustainability Accounting Requirements Forums) will assist keep in touch the suitable message to stakeholders and cut back the inherent transition menace.

Our sustainability framework is designed to empower and improve you. We’re dedicated to partnering for your weather transition adventure and serving to you mobilize impactful, sustainable movements to reinvent your company.

As a globally famend era and virtual chief, Capgemini inherits the duty, the ambition, and the way to give a contribution to fixing primary societal questions that form our global – and with weather trade on the middle of our workforce priorities, we’re contributing to creating this ambition a truth.